FP&A Framework to prevent the business failure

Why a Strong FP&A Framework Is Key to Preventing Business Failure

Strategic FP&A: preventing business crisis begins with a well-constructed control and management system.

In Italy, the Business Crisis and Insolvency Code (D.Lgs 14/2019) and the Civil Code (art. 2086) require companies to adopt, from the start of their activity, adequate organizational, administrative, and accounting structures. These structures must support not only efficient operations but also early identification of crisis and business continuity risks.

This is a good law. It promotes a culture of prevention and responsibility. But the issue is that many companies start from the end, focusing only on formal compliance: asking how to monitor, which thresholds to use. Only when signs of crisis emerge (liquidity issues, falling margins, creditor tensions), do they implement control tools.

This is a formal and reactive approach. Systems are introduced in response to symptoms—not to prevent them. That’s the critical flaw.

A structured and strategic approach

At FinDep Consult, we promote a radically different approach: strategic and vision-driven.

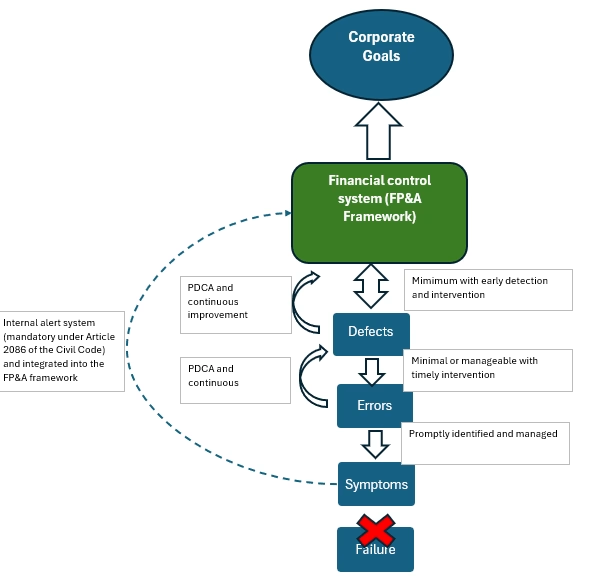

A business is founded with a purpose. Crisis is not part of that purpose. A company is born to create value, achieve goals, grow. To face internal and external challenges, a company needs a robust system—not to manage crises, but to reach results. If that system works, crises either don’t occur or are addressed early and effectively.

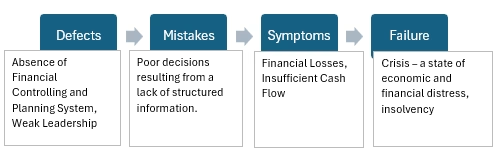

The Argenti Model: Defects – Errors – Symptoms – Failure

The Argenti model clearly describes the path to business failure.

- Defects: structural weaknesses (lack of control, weak leadership, no planning)

- Mistakes: wrong decisions caused by those defects

- Symptoms: visible signs (liquidity issues, revenue drop, delays)

- Failure: actual business collapse

Many companies don’t address the defects. They make errors. Only when symptoms emerge do they act—but by then, the damage is done.

The implementation of "adequate structures" happens too often in reaction to symptoms. That’s not prevention. It’s containment.

FinDep Consult’s approach: Strategic FP&A from the beginning

Our FP&A approach is based on a simple principle: it all starts with objectives.- Initial analysis: we assess if the company already shows symptoms, comparing the current state (as is) to the desired one (to be).

- Plan development: we define economic and financial objectives and create a long-term plan to close the gap.

- Concrete actions: we identify actions to mitigate risks and implement the strategy.

- Integrated monitoring: tools like budgeting, cash planning, and reporting are designed to support objectives—not as ends in themselves.

An adaptive approach across business life cycles

Each business phase requires a tailored approach:

- Start-up: the challenge is managing uncertainty and securing funding to support growth.

- Rapid growth: plans need constant updates to reflect evolving potential; FP&A supports goal setting and execution.

- Maturity: focus shifts to operational efficiency, margin optimization, and profitability control.

- Decline or crisis: first restore stability, then resume strategic planning with new goals.

Tools matter—but vision comes first

Tools like budgets, cash flows, variance analysis, monthly reports, and KPIs are essential. But they’re not enough without a clear vision.

The starting point is always the why: why does the business exist, where is it going, how do we measure progress? That’s what drives our approach.

But what does "starting from objectives" really mean? It’s more than a good slogan—it’s a disciplined, structured practice. Strategic FP&A must be informed, 360° aware, and grounded in the actual company context.

First step: build a complete financial model

The process starts with a 3-statement Operational Financial Model (P&L, balance sheet, cash flow). Even one year of historical data is enough to:

- model the current structure,

- reconcile with existing reports,

- create forward-looking projections based on solid assumptions.

At this point, Strategic FP&A knows the cost and revenue structure, existing contracts, and short- and long-term plans. The model becomes a shared, in-depth understanding of the company—not just a technical exercise.

It’s normal that the model raises doubts initially: that’s part of the learning. It should be tested, validated, improved—and built from day one with a future-ready architecture.

It must be:

- robust (able to evolve with the business),

- transparent (easily adjustable and traceable),

- fast and efficient (responsive to change).

From strategy to operational control

The model is the foundation of the strategic business plan (3–5 years), from which derive:

- the annual budget,

- the cash flow forecast,

- short-term control tools.

The budget is the first milestone. But to ensure it’s followed, a robust performance management system is essential, including:

- clear KPIs,

- systematic monitoring,

- cost and revenue tracking,

- cost per unit, margins, operating volumes.

All adapted to the company’s structure and industry.

At this point, reporting and early warning mechanisms required by law trigger automatically—they’re already built into the system.

To dive deeper into the technical aspects of building robust financial models, budgeting in complex matrix organizations, and integrating performance management across sectors, follow us for more insights. We’ll share case studies, practical tools, and examples from real FP&A transformations by FinDep Consult.

Conclusion

Bottom line: you don’t need a system for the crisis. You need one to avoid it in the first place. And that system is built through vision, discipline, and control.

FinDep Consult supports companies in designing and evolving these systems—not as formal obligations, but as real strategic levers.

You need a robust system to achieve goals, respond to external pressures, and reduce internal risks. A well-built system, free of defects or under continuous improvement, prevents errors and symptoms from even arising. That’s how control becomes a growth enabler—not just a compliance tool.

Follow FinDep Consult for updates on interim CFOs, FP&A, M&A, and customized financial strategies.

Request your free consultation with our FP&A experts and strengthen your company’s financial control systems.

👤 About the Author

She is an ACCA Fellow member and CPA in Italy. With over 25 years of international experience in senior finance leadership roles, she has led complex post-M&A finance integrations across borders—especially in the Italian market.

Her expertise spans the full Finance spectrum—from accounting and controlling to business intelligence and FP&A transformation. She has built Finance functions from scratch for high-growth companies, implementing data-driven models and positioning Finance as a strategic business partner.

Anastasia is passionate about empowering modern Finance professionals to go beyond traditional reporting—embracing strategy, communication, and measurable business impact. Through FinDep Consult, she champions a vision of Finance as a true growth driver, not just a back-office function.